Should You Buy or Rent? Key Considerations for 2025

Introduction:

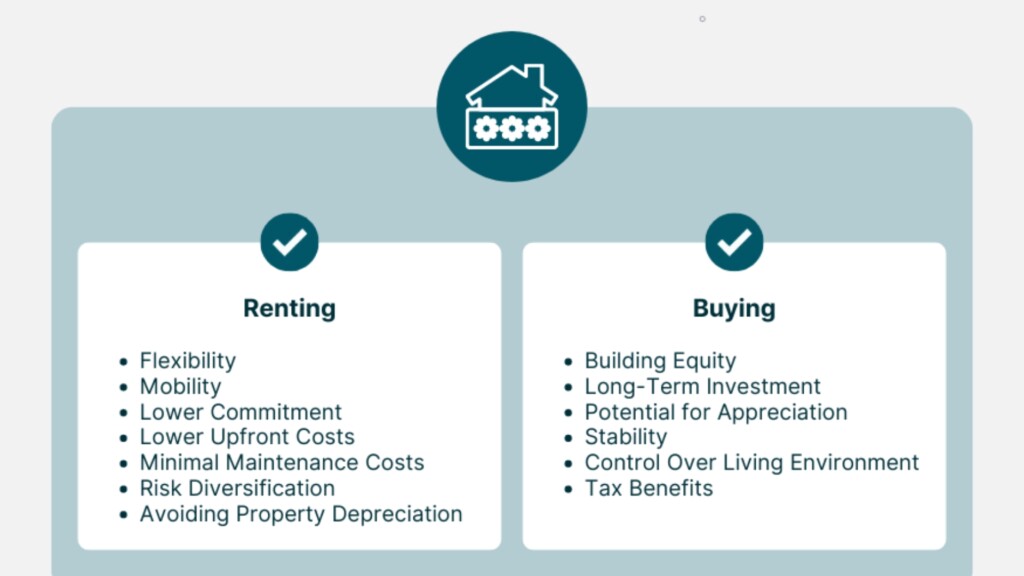

The decision to buy or rent a property is one of the most significant financial choices you’ll make in your lifetime. While buying offers long-term investment potential, renting provides flexibility and fewer responsibilities. In 2025, this decision is even more complex, given the changing market trends, interest rates, and lifestyle preferences. So, should you buy or rent? This article explores the key considerations to help you decide whether buying or renting is the right choice for you in 2025.

1. Current Market Conditions: Impact of Interest Rates and Housing Prices

The real estate market in 2025 is expected to have a significant impact on your decision to buy or rent. As interest rates fluctuate and housing prices continue to rise in many areas, it’s essential to understand the broader market conditions before making a decision:

- Interest Rates: Mortgage rates in 2025 are expected to be higher than in previous years, which may result in higher monthly mortgage payments. If you’re planning to buy a home, consider whether you can comfortably afford the higher interest rates. Higher rates can also affect your purchasing power, limiting the types of properties you can afford.

- Housing Prices: The housing market is still experiencing price increases in many regions, making it harder for first-time buyers to get into the market. As demand continues to outstrip supply in some areas, renting may provide a more affordable alternative in the short term.

Before making a decision, it’s essential to assess how these market conditions will impact your budget and long-term financial goals.

Image Alt Text: Real estate market trends in 2025 with a focus on housing prices and interest rates.

2. Financial Stability and Long-Term Investment Potential

Your financial stability is one of the most important factors when deciding whether to buy or rent. Buying a home is a long-term commitment that requires a stable income, savings for a down payment, and the ability to handle maintenance and unexpected costs. Key financial considerations include:

- Down Payment: If you plan to buy, you’ll need to save for a down payment, which is typically between 10-20% of the property’s value. Consider how long it will take to save enough for a down payment and if you’re ready to make that financial commitment.

- Monthly Payments: When you buy, you’ll need to account for mortgage payments, property taxes, insurance, and maintenance. When you rent, your monthly payments are typically more predictable, with rent costs and sometimes utilities included.

- Long-Term Investment: Buying a home can be a solid long-term investment, as property values tend to appreciate over time. However, if the market is volatile, renting may allow you to avoid potential losses if property prices drop in the future.

Assess your current financial situation and future plans to determine which option aligns better with your budget and investment goals.

3. Flexibility and Lifestyle Needs

One of the most significant advantages of renting is flexibility. If you’re not ready to commit to a permanent residence or anticipate moving in the near future, renting may be the best choice. Here are some lifestyle factors to consider:

- Job Relocation: If you’re in a job that could require relocation or anticipate changes in your career, renting allows you to move easily without the burden of selling a property.

- Urban vs. Suburban: Renting can give you the flexibility to live in urban areas with more job opportunities, public transportation options, and entertainment. On the other hand, buying a home might be a better option if you want more space, privacy, and a long-term place to settle down, especially in suburban areas.

- Maintenance and Responsibility: When you rent, the landlord is generally responsible for property maintenance and repairs, while homeowners are responsible for everything. If you’re not ready to take on the responsibilities of homeownership, renting offers a more hassle-free option.

If flexibility and lifestyle convenience are your top priorities, renting may suit your needs better than buying.

Image Alt Text: Renting vs buying decision based on lifestyle, flexibility, and long-term commitment.

4. Long-Term Financial Goals and Equity Building

While renting provides flexibility, buying a home offers the opportunity to build equity over time. When you buy, your mortgage payments contribute to ownership of the property, while renting means you’re paying for the right to live in the space without building any ownership. Consider the following:

- Building Equity: With a mortgage, you are essentially paying into the property rather than paying someone else’s mortgage. Over time, as you pay down the loan, you build equity in your home, which can be a significant asset.

- Wealth Accumulation: Homeownership is often a pathway to wealth accumulation, as property values generally rise over time. While there are risks in volatile markets, long-term property ownership often proves to be a good investment.

- Renting Does Not Build Equity: Rent payments provide no return on investment. The money you pay each month doesn’t go toward ownership or equity but simply supports the landlord’s investment. However, renting can be more financially viable if market conditions aren’t favorable for buying.

If you’re looking for long-term financial growth and stability, buying a home offers the chance to accumulate equity and build wealth over time.

5. Maintenance and Additional Costs

Maintenance is another key factor to consider when deciding between buying or renting. As a homeowner, you are responsible for repairs, maintenance, and upkeep of the property. This can include anything from replacing appliances to fixing plumbing issues. Renters, on the other hand, usually have fewer responsibilities in this area.

- Homeownership Costs: In addition to the mortgage, homeowners must factor in costs for home maintenance, repairs, property taxes, and utilities. Unexpected expenses, such as roof repairs or plumbing issues, can add up quickly.

- Renting Costs: Renters typically don’t have to worry about maintenance, but they may face rent increases or be subject to rules set by the landlord. In some cases, renters may have to pay utilities and other associated costs.

While homeownership can be a financial benefit in the long run, it’s important to be aware of the additional responsibilities and potential costs.

6. Local Market and Property Trends in 2025

Understanding the local real estate market and trends in 2025 is essential when deciding whether to buy or rent. Some markets may be more favorable for renters, while others may provide opportunities for buyers. Keep an eye on:

- Renting Demand: In some areas, particularly urban locations with high job growth, rental demand is increasing, making it a competitive market for renters. If this is the case in your area, renting may be a practical short-term solution until property prices stabilize.

- Buyers’ Markets: In other locations, where home prices may be more affordable or the market has a higher inventory of homes for sale, it could be a good time to buy. A buyer’s market with lower prices and fewer competitors could make purchasing a home more attractive.

- Property Appreciation: Research whether property values in your area are likely to increase in the coming years. If property values are projected to rise, buying now could be a wise investment.

Stay informed about your local market conditions and trends to make a more educated decision about whether to buy or rent.

Image Alt Text: Local market conditions and property trends in 2025 for buying vs renting decisions.

Conclusion

The decision to buy or rent is a personal one and depends on various factors, including market conditions, financial stability, lifestyle preferences, and long-term goals. In 2025, higher mortgage rates, increasing property values, and the continued demand for rental properties all play a significant role in shaping your options. By evaluating your financial situation, considering the local market, and aligning your decision with your personal goals, you can make an informed choice that works for you .

Whether you decide to buy or rent, make sure to do thorough research, stay aware of market trends, and choose the option that best fits your needs in the coming year. For more expert advice and resources on buying, renting, and investing in real estate, visit our website for additional insights and tips.